Why A Drop In AUD Can Benefit Mining Plant Hire

The mining industry in Australia is rapidly changing. The value of the Australian dollar has fallen, and mining equipment demand has vastly changed. As these changes continue to shape the industry, business owners must adapt to stay ahead.

Australian dollar’s decrease in value impacts mining machinery industry

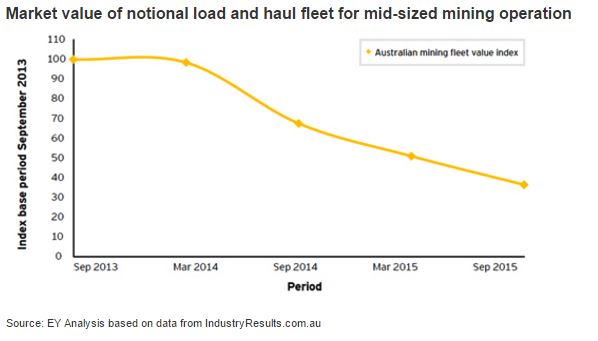

According to Ernst & Young’s 2016 Australian Yellow Goods report, which analyses the outlook for the construction and earthmoving equipment market, mining fleet value has fallen 64% since September 2013. Due to the end of the mining boom and the fall of commodity prices, mining equipment has seen a steady decrease over the past 2.5 years.

The end of the mining boom has had a substantial impact on the mining industry as a whole; specifically in mining jobs and mining machinery.

Weak AUD encourages shift to mining hire

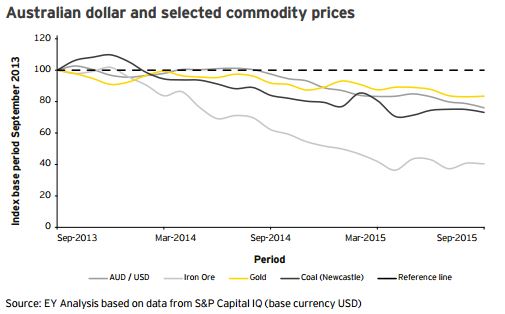

The related fall of the Australian dollar against the US dollar has also affected the mining machinery industry. As the value of the AUD fluctuates, prices of imported goods increase. The drop in the dollar’s value has increased the price of imported goods.

As most mining machinery in Australia is imported, this means that prices of mining machinery have increased, making machinery less accessible.

Rising machinery costs = harder to access

The weakened dollar and rising machinery costs have created barriers to entry in the mining industry, especially for new companies hoping to enter the market.

Instead of purchasing new machinery, it presents an opportunity to hire used mining machinery. Due to the decrease in dollar value and increase in machinery costs, hiring equipment can be a superior solution to gain a competitive advantage.

Mining machinery hire advantages

As barriers prevent new entrants to the market, mining machinery hire companies will experience an increase in demand.

As the yellow goods market decreases, people who need mining machinery should avoid investing in new mining machinery, as it will likely see a further decrease, according to EY. Renting mining machinery is a more cost effective option at this point, as there is an excess of mining machinery but a deficit in demand for this machinery.

As machinery value decreases, hire becomes more attractive

According to EY’s mining and metals leader Paul Murphy, “any recovery in the mining segment is a long way off.” The yellow goods marketing is unlikely to recover this year, so those involved in the mining industry should take note.

Although it isn’t a good time to invest in your own mining equipment, it is the ideal time to hire mining equipment. Consider the costs of renting versus buying your equipment to make sure you are making the correct decision for your situation and your business.

Mine closures and lower commodity prices make now a poor time to invest in mining equipment, so those in the mining industry or looking to enter the market should opt for hire machinery.

Conclusion

Are you interested in learning more about the mining machinery industry? Check out our mining machinery blog, or contact Minspares for more information.