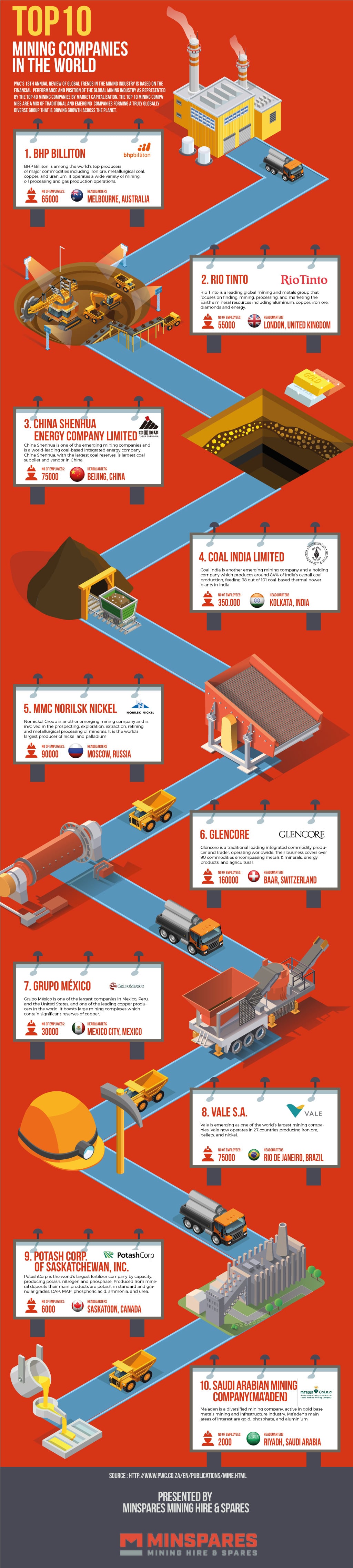

Top 10 Mining Companies in the World

The top 10 mining companies act as a proxy for the performance of the mining industry.

PwC’s 13th annual review of global trends in the mining industry is based on the financial performance and position of the global mining industry as represented by the Top 40 mining companies by market capitalisation.

It is within the power of the Top 40 to rebuild after a mining slump. As much as it is true that the top 40 mining companies provide a guide as to how the mining industry may look in the future, the top 10 companies provide a clear picture of the heights they may reach again.

The top 10 mining companies are a mix of traditional and emerging companies forming a truly globally diverse group that is driving growth across the planet.

Share this Image On Your Site

BHP Billiton (UK/Australia)

BHP Billiton is among the world’s top producers of major commodities including iron ore, metallurgical coal, copper, and uranium. It operates a wide variety of mining, processing and oil and gas production operations in over 25 countries employing approximately 65,000 people.

It is a truly global company with their products being sold worldwide, with sales and marketing led through Singapore and Houston, United States. BHP Billiton’s global headquarters are in Melbourne, Australia.

It trades in Australia, United States of America, United Kingdom, and South Africa.

In recent news, Australia’s BHP Billiton also made history by becoming the first foreign company to join state oil firm Petróleos Mexicanos in developing the already discovered Trion oil field in the Gulf of Mexico.

Rio Tinto (UK/Australia)

Rio Tinto is a leading global mining and metals group that focuses on finding, mining, processing, and marketing the Earth’s mineral resources including aluminum, copper, iron ore and diamonds and energy.

Their 55,000 people work in more than 40 countries across six continents. Strongly represented in Australia and North America, and also have significant businesses in Asia, Europe, Africa and South America.

It trades in Australia, United States of America, and the United Kingdom.

In recent news, Rio Tinto outlined their new $5 billion productivity push under long-term strategy focused on cash generation spanning until 2021.

China Shenhua Energy Company Limited (China/Hong Kong)

China Shenhua is one of the emerging mining companies and is a world-leading coal-based integrated energy company. Its main business includes production and sales of coal, railway, and port transportation of coal-related materials, as well as power generation and sales.

China Shenhua, with the largest coal reserves, is largest coal supplier and vendor in China employing approximately 75,000 people. It trades on the Hong Kong and Shanghai stock exchanges.

In recent news, Shenhua Group is said to be seeking to limit sales of the fuel to end-users and choke off supplies to traders amid government pressure on the nation’s major miners to cool surging prices.

Coal India Limited (India)

Coal India another emerging mining company and is a holding company which encompasses the whole gamut of identification of coal reserves, detailed exploration followed by design and implementation and optimizing operations for coal extraction in its mines.

Coal India produces around 84% of India’s overall coal production, feeds 98 out of 101 coal-based thermal power plants in India and employs approximately 350,000 people.

It trades on the Bombay and National India stock exchanges.

In recent news, Senior Indian government officials tasked by Prime Minister Narendra Modi with reviewing energy security are recommending the break-up of the country’s coal monopoly into seven companies, which they say would make it more competitive and efficient.

MMC Norilsk Nickel (Russia)

Nornickel Group is another emerging mining company and involved in prospecting, exploration, extraction, refining and metallurgical processing of minerals. As well as the production, marketing and sale of base and precious metals.

It is the world’s largest producer of nickel and palladium and one of the world’s leading producers of platinum and copper employing approximately 90,000 people.

It is traded in Russia and the United Kingdom.

In recent news, the Group has filed lawsuits against the Botswana-based BCL group (BCL) to enforce the sale of Nornickel’s 50% stake in a joint venture Nkomati to BCL. This offtake agreement enables Nornickel to retain control over the distribution of a desirable product given the rising deficit in the nickel market.

Glencore (UK/Australia)

Glencore is a traditional leading integrated commodity producer and trader, operating worldwide. Their business covers over 90 commodities encompassing metals & minerals, energy products, and agricultural products as well as related marketing and logistics activities.

It is traded in Hong Kong, South Africa, and the United Kingdom. It is supported by a global network of more than 90 offices located in over 50 countries employing around 160,000 people, including contractors.

In recent news, Glencore and Qatar’s sovereign wealth fund have together acquired a 19.5 percent stake in Russia’s top state-controlled oil company, Rosneft, representing a surprising turnaround for Glencore, which only last year faced doubts about its ability to handle its debts.

Grupo México (Mexico)

Grupo México is one of the largest companies in Mexico, Peru, and the United States, and one of the leading copper producers in the world.

Its main activities are in the mining-metallurgic industry, the exploration, exploitation, and benefit of metallic and non-metallic ores, multi-modal freight railroad service, and infrastructure development based in Mexico City.

It boasts large mining complexes which contain significant reserves of copper employing approximately 30,000 people.

It is traded on the Mexican Stock Exchange.

In recent news, Grupo Mexico was the only company that rose in Mexico’s IPC stock index since the Nov. 8 U.S. election, as Trump’s $550 billion infrastructure pledge helps fuel the biggest surge in copper prices in seven years.

Vale S.A. (Brazil)

Vale is emerging as one of the world’s largest mining companies. They also have major operations in the areas of logistics, power, and steelmaking.

Vale operates in 27 countries employing approximately 75,000 people across all sectors. Leaders in the production of iron ore, pellets, and nickel. They also produce manganese ferroalloys, coal copper, gold, silver, cobalt and fertilisers.

It is traded in Indonesia, Honk Kong, Madrid and New York.

In recent news, Vale trading in New York is projected to declare fiscal fourth quarter financial results right before the stock market’s official open on March 02, 2017. The stock added about 27.5 percent in price since last results when it was at $6.91 a share.

Potash Corp. of Saskatchewan, Inc. (Canada)

PotashCorp is the world’s largest fertilizer company by capacity, producing potash, nitrogen and phosphate. Produced from mineral deposits their main products are potash, in standard and granular grades, DAP, MAP, phosphoric acid, ammonia, and urea.

They have a number of facilities across North and South America as well as the Middle East and China employing approximately 6,000 people.

Common shares of Potash Corporation of Saskatchewan Inc. are listed on the Toronto Stock Exchange and the New York Stock Exchange.

In recent news, Potash Corp was recognized for excellence in corporate reporting for narrating a well-organized and complete story that went above and beyond in explaining the company’s strategies, risks, uncertainties, forecasts and outcomes, the judges said.

Saudi Arabian Mining Company (Ma’aden) (Saudi Arabia)

Ma’aden is a diversified mining company, active in gold base metals mining and infrastructure industry. Ma’aden was wholly owned by the Saudi Government before 50% of its shares were floated on the Saudi Stock Exchange in 2008.

Ma’aden’s main areas of interest are gold, phosphate, and aluminium. Ma’aden is constantly working on expansion of its business portfolio, discovery, and evaluation of sites for new metals. It operates solely in Saudi Arabia and employs approximately 2,000 people.

In recent news, Saudi Arabian Mining Co. plans to double gold production by 2020 and is increasing output of other commodities from aluminium to ammonia as the world’s biggest crude oil exporter seeks to diversify its economy.

Summary

The 2025 edition of Mine might reflect differently due to changes within the Industry. Fresh contenders are being nominated from many locations to take the mantle. Or will the old guard remain largely intact, proving there is no substitute for experience?

During 2015, many of the established members of the Top 40 marked below their book values for the first time in the history of the Mine report. There is a lot of time and energy being sunk into creating efficiencies and cost-savings, which considering mining is a long-term game will likely set them for future growth and sustainability.